Ohio resident Matthew James Collins hauls frozen food around the Midwest — onion rings, ice cream and the like. On a recent October morning, Collins was trucking through a snowstorm in Minnesota.

He wasn’t carrying much. Collins recalled when he ran this route last year, he would regularly move 22 skids of frozen foods (a type of pallet) for four different corporate accounts. Now he’s moving just 12 skids for two clients.

The health of the trucking industry is typically a good gauge for how the U.S. economy at large is faring. That’s not the case right now. Economists remain stunned by how much stuff Americans are buying amid historic inflation and interest rate hikes. At the same time, the trucking industry is embroiled in a meltdown that’s slamming operators large and small.

“It doesn’t even seem like the broader economy even knows we’re in a recession,” said Steve Troyer, president of California Midwest Xpress, a 30-truck fleet. “But we’re in a good one.”

Americans are spending a larger chunk of their income on durable goods than they did before the pandemic, according to Goldman Sachs research. The U.S. economy saw “blockbuster” growth in the third quarter of 2023; it was the biggest surge in nearly two years, and attributed in part to increased consumer spending. Around 72.6% of the nation’s freight by weight is hauled by semi-truck. If Americans are buying so much, why aren’t truckers seeing a boon?

This trucking bloodbath is particularly gory

Trucking is a highly cyclical industry. During good times, manufacturers deliver more equipment to trucking fleets that want to expand and capture that surfeit of business and profits. Individuals open their own trucking fleets too.

The boom time typically lasts for under a year. Inevitably, so much capacity enters the industry and depresses rates again. Whatever trend outside of trucking that was spurring all of that new demand usually runs dry too. That means too many trucks and not enough freight to move.

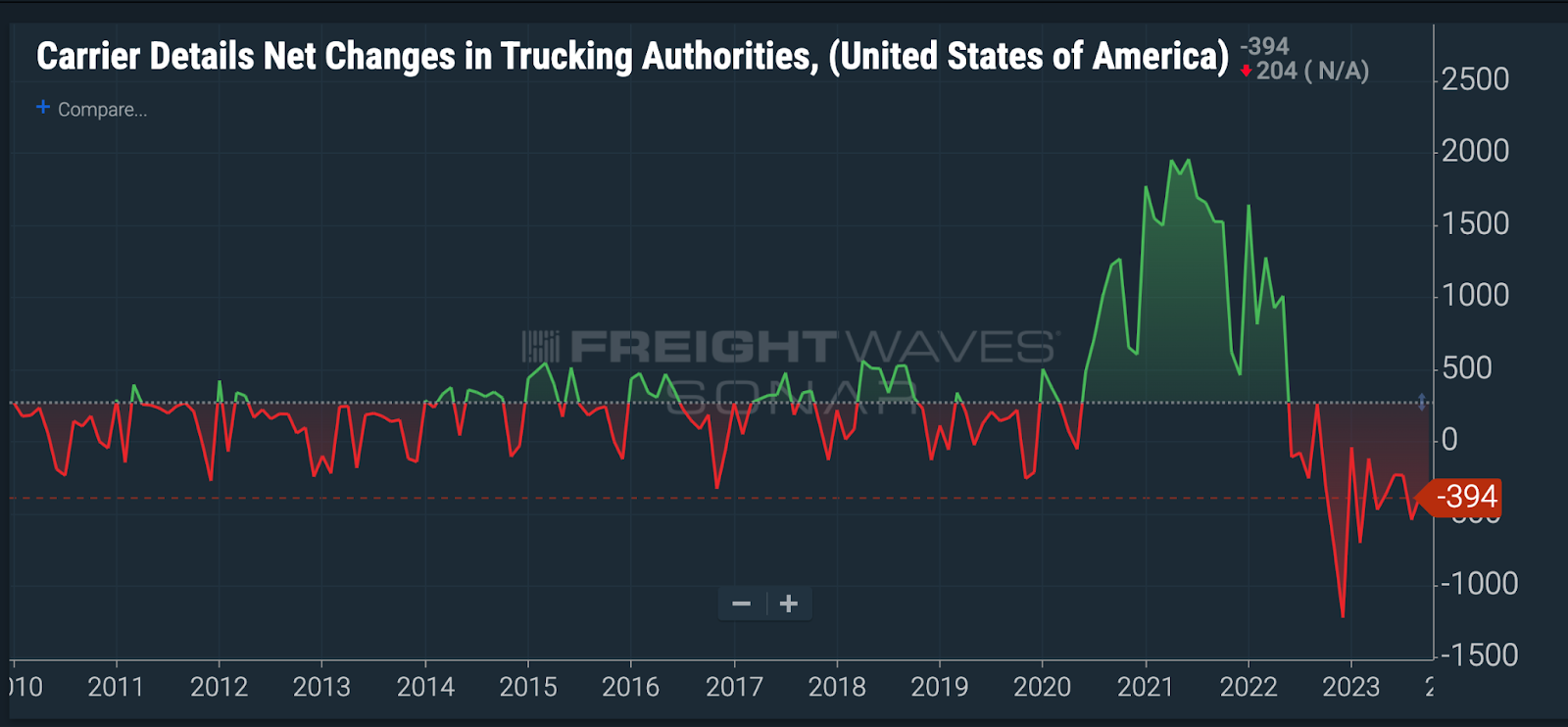

The federal government tracks the number of trucking authorities created or shut down every month. Authorities are often put out of service after they fail to pay insurance premiums. In typical upcycles, a few hundred net trucking authorities are created, then a few hundred net trucking authorities are destroyed when the market flips less than a year later.

The most recent freight upcycle quashed that pattern. The upcycle began around June 2020, when the federal government approved about 500 net trucking authorities. That reached a fever pitch in the summer of 2021, when around 2,000 net trucking authorities were created in a single month. It wasn’t until June 2022 when the cycle turned and net trucking authorities flipped back to negative.

The pandemic trucking boom lasted twice as long as a typical upswing. And each month created many times more trucking companies than a typical red-hot trucking month.

There’s still a massive excess of trucking authorities, according to federal data. In January 2020, there were around 255,000 authorities. Now there are around 363,000 authorities. Most of these businesses are small fleets with fewer than 10 drivers.

Tens of thousands of those new carriers have already shut down. According to a FreightWaves analysis of federal data, an estimated 35,000 new trucking companies shuttered in the fiscal year ending Sept. 30. For the 10 years before that, the average number of out-of-service orders was 15,585.

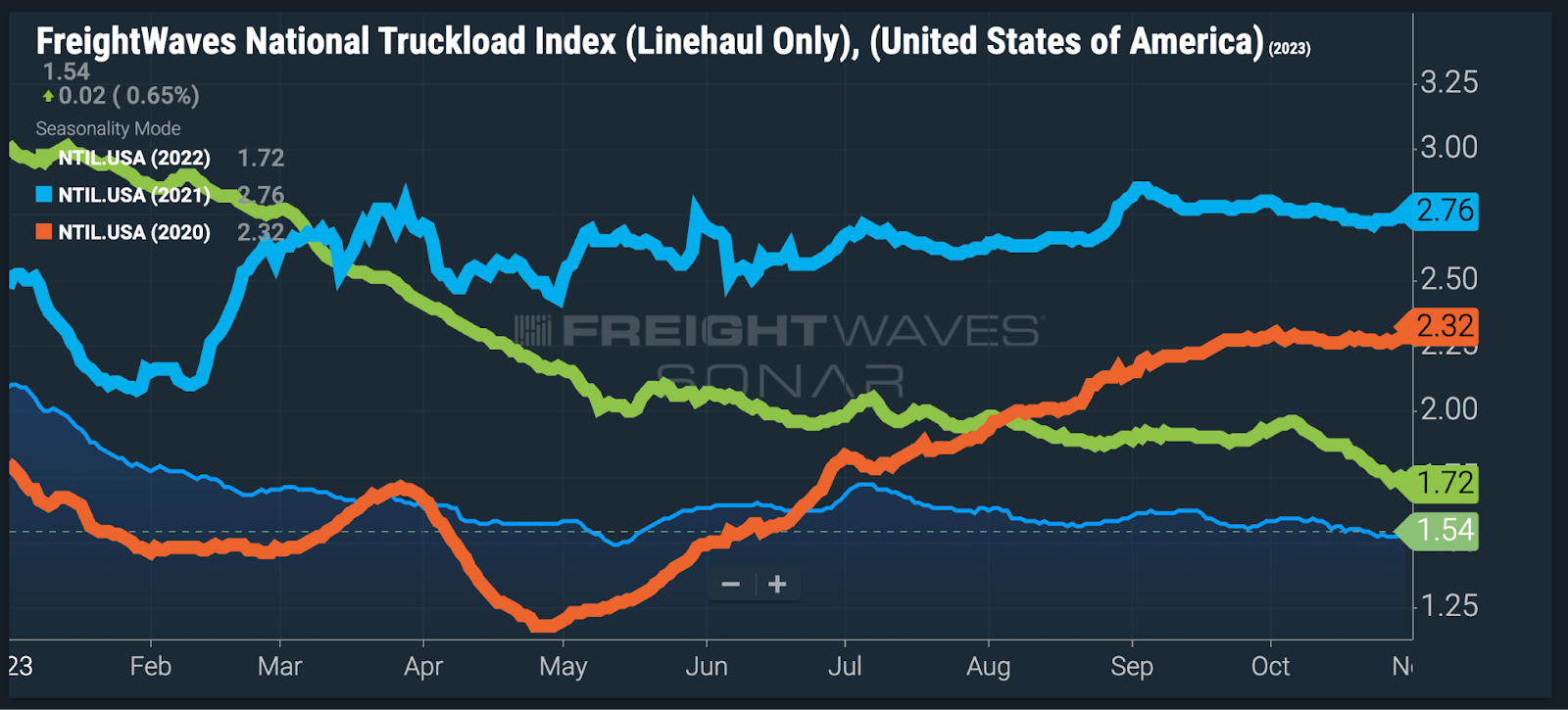

Average per-mile spot rates for trucking fleets have hit $1.54, down 11.6% from 2022 and 34.4% from 2021, according to the FreightWaves National Truckload Index. At the same time, the costs of fuel, replacement parts, insurance and other key inputs have soared.

Brian Carle, a New Mexico truck driver who has his own authority, said jobs are so scarce and poorly paid right now that he has to save up just to get an oil change. His gross earnings this year will be about 33% less than they were in 2021 — but the cost of everything, like repairs, diesel and routine maintenance, has soared.

“Everything I’m paying for, I’m not getting paid more for,” Carle said. “Something’s gonna break.”

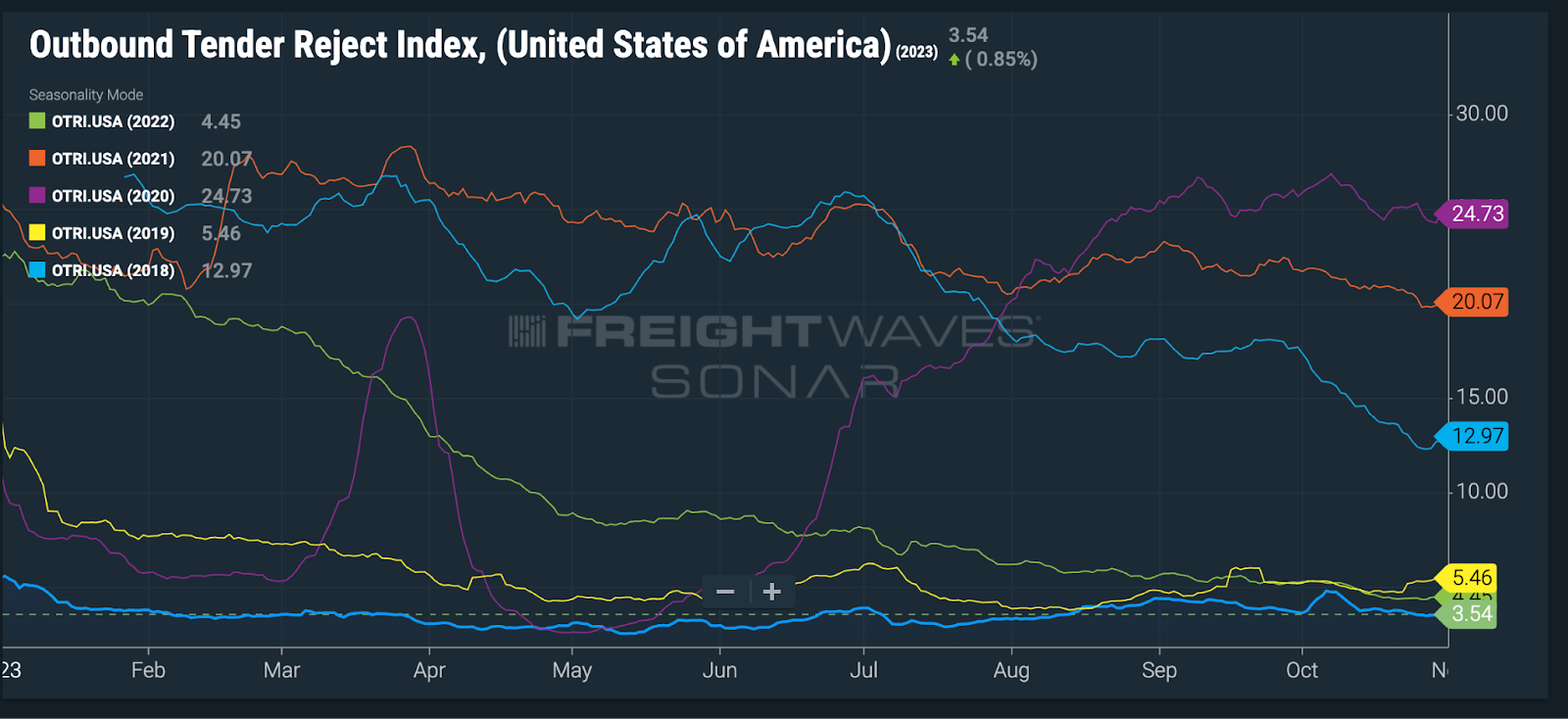

Reflecting that, trucking carriers are only rejecting some 3.5% of contract loads, according to the FreightWaves Outbound Tender Reject Index. That’s even lower than 2019 and 2022, two challenging years for truckers.

“We’re going to have to see trucks leave the market for rates to come back down,” said Collins, the Ohio truck driver. “We also need a stronger economy for rates to come back up.”

American consumers are buying stuff again. Woo-hoo!

The U.S. economy grew faster than expected in the third quarter of 2023. At 4.9%, it was the biggest uptick since the fourth quarter of 2021. Much of that boost came from increased purchases of durable goods; new orders for durable goods are up 4.4% so far this year compared to 2022.

For this increase, thank the slowdown of inflation — and the relentless American urge to go on a shopping spree.

“When the economic history of the early 21st century comes to be written, the opening sentence in a bold font should be ‘never go short the hedonism of the US consumer,’” wrote Paul Donovan, UBS global chief economist, in a note last Friday. “Middle-income consumers have lower inflation than consumer price data implies, giving them more spending power.”

Americans are still buying a lot of stuff, despite the Federal Reserve’s attempts to curb spending and corporate zeal to increase the price of everything. Joseph Politano, author of the financial newsletter Apricitas Economics, said continued strong spending reflects the strong labor market.

“The vast majority of people spend a fixed portion, which is the majority of their income, on things,” Politano said. “Over the last year, you have 3.2 million new jobs and employment rates at a very high level. It shouldn’t be too surprising that spending is remaining strong under those conditions.”

Spendy American consumers aren’t saving trucking

No one expected the 2020 to 2021 spending spree to last.

“You had like those insane months where there was a million new jobs and spending growth was 9%,” Politano said. “Obviously, no one ever expected that to [last] forever.”

However, that didn’t stop more than 100,000 truck drivers from opening up their own trucking companies. And while it’s easy enough for the American consumer to scale up or scale down their spending, truck drivers can’t turn on or off their level of capacity as seamlessly.

The only level of freight demand that could support that “excess” trucking capacity is one that matches the Great Shopping Spree of 2021. That level of consumerism — where more than 100 container ships are waiting to unload at the ports of Los Angeles and Long Beach, full of stuff purchased with stimulus checks — was likely a once-in-a-lifetime event.

Analysts believe that the trucking industry will only become healthy again when a significant chunk of those authorities are cleared out. That likely means the collapse of tens of thousands of trucking businesses, even beyond the tens of thousands that have already shut down.

For his part, Carle, the New Mexico truck driver, isn’t keen on closing down his business. “I don’t want to give up what I’ve worked so hard for.”

Are you a carrier, shipper, or broker? Email [email protected] with your experience of the trucking bloodbath. Please subscribe to the MODES newsletter for weekly updates.