This week’s FreightWaves Supply Chain Pricing Power Index: 40 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 40 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 40 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Accepted volumes could soon be outpaced by 2020 levels

Freight demand is quiet at the beginning of August. Even though this current period is historically soft, it is increasingly dubious that the back-to-school shopping season will provide any meaningful boost to tender volumes. Despite data from the National Retail Federation projecting that spending on school supplies will match or exceed that of previous years, most of these gains come from inflation, not increased demand.

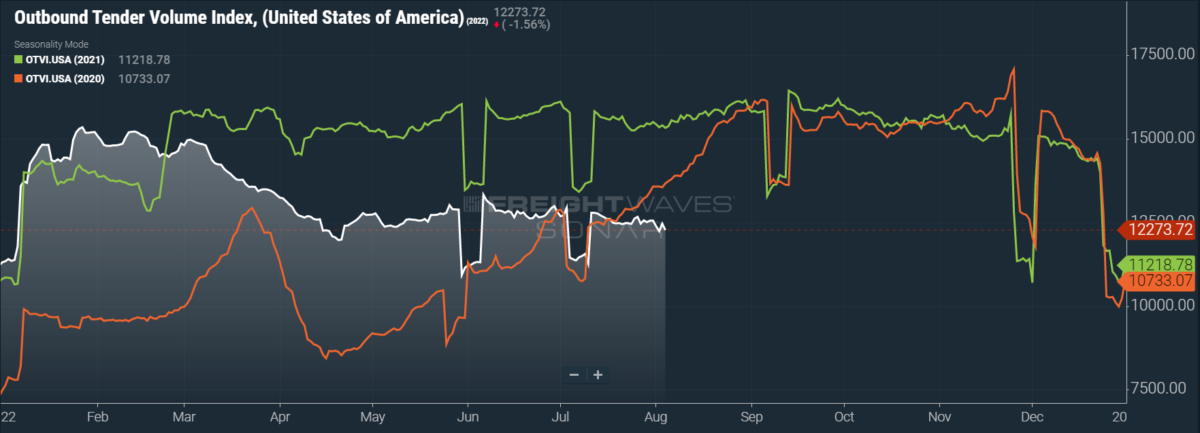

SONAR: OTVI.USA: 2022 (white), 2021 (green) and 2020 (orange)

To learn more about FreightWaves SONAR, click here.

OTVI fell 2.3% on a week-over-week (w/w) basis as shippers have little urgency to move their goods. On a year-over-year (y/y) basis, OTVI is down 20.2%, although y/y comparisons can be colored by significant shifts in tender rejections. OTVI, which includes both accepted and rejected tenders, can be artificially inflated by an uptick in the Outbound Tender Reject Index (OTRI).

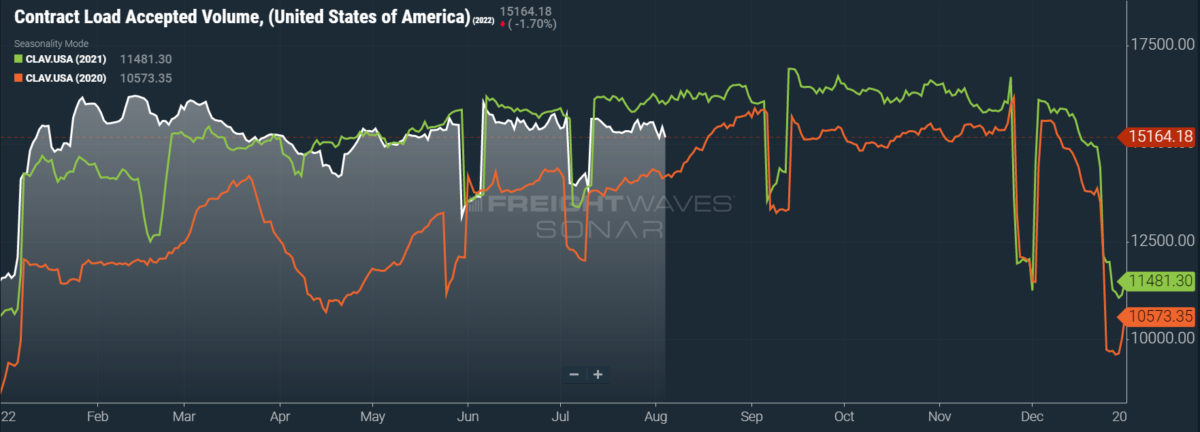

SONAR: CLAV.USA: 2022 (white), 2021 (green) and 2020 (orange)

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see not only a dip of 2.34% w/w but also a gap of 5.28% y/y. This y/y difference confirms that actual cracks in freight demand — and not merely OTRI’s y/y decline — are driving OTVI to lower levels.

Given the high truckload rates of 2021 and their swelling inventories of late, many shippers have redirected their freight from over-the-road transport to the rails. But since rail service has deteriorated to such an extent, some shippers that traditionally move freight on the rails are instead turning to long-haul truckloads. To make matters worse for rail shippers, contract negotiations between the railroads and the unions have yet to reach a conclusion after more than 2 1/2 years. The Biden administration has tasked a three-member committee to break the deadlock; the panel’s findings are due for release by Aug. 16.

Ongoing labor negotiations are not confined to the rails, as talks between the Pacific Maritime Association and the International Longshore and Warehouse Union (ILWU) have yet to resolve, despite the previous contract expiring at the start of July. One major concession could be made by Congress to the ILWU: In a revised inflation bill, $3 billion worth of grants have been set aside for the ports. The caveat is that no part of this money can be used to invest in automation technology, which the ILWU has historically opposed as an existential threat to its members’ employment.

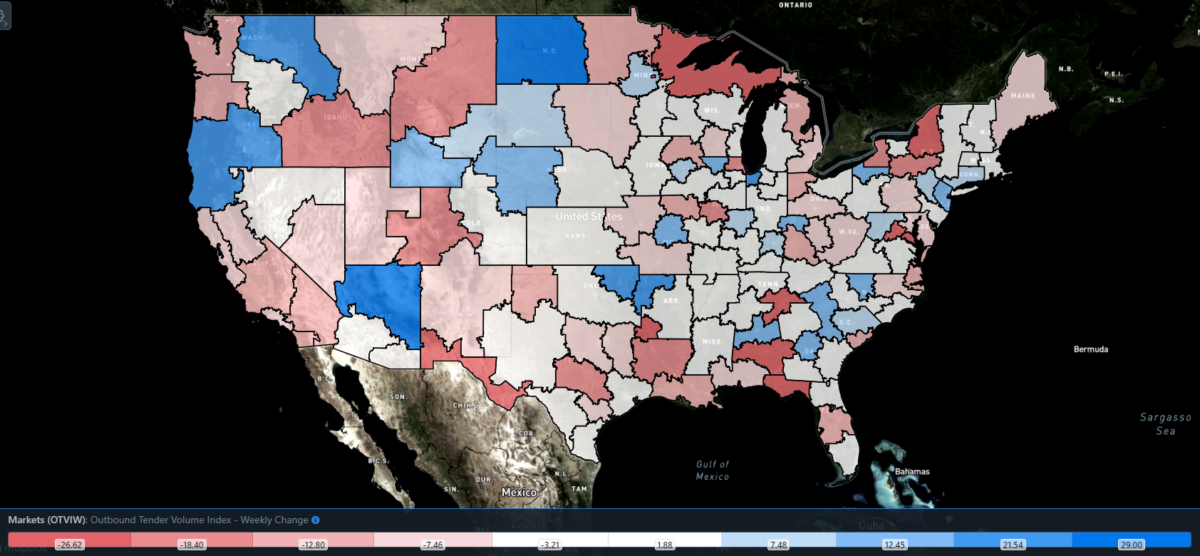

SONAR: Outbound Tender Volume Index – Weekly Change (OTVIW).

To learn more about FreightWaves SONAR, click here.

Of the 135 total markets, 52 reported weekly increases in freight demand, with many of the largest markets seeing significant w/w contraction.

Atlanta, the nation’s largest market by outbound volume, saw tender volumes drop 2.7% w/w. Ontario, California — both the second-largest outbound market and one that handles much of the freight from the nearby Ports of Los Angeles and Long Beach — suffered a drastic decline in freight demand. Ontario saw volumes fall 12.3% w/w. With its recent umbrage surrounding House Speaker Nancy Pelosi’s visit to Taiwan, China has been retaliating with live-fire exercises in the Taiwan Strait. It goes without saying that such military posturing could affect the flow of freight through one of the world’s busiest straits, particularly freight destined for the Ontario market.

By mode: While muted, reefer volume is seeing some weekly growth and has been one of the brighter spots in the industry over the past month. Part of this growth is due to produce season, especially produce shipping out of California. The Reefer Outbound Tender Volume Index (ROTVI) is up a scant 0.53% w/w, managing to outperform the overall OTVI.

Van volumes, meanwhile, are a major driver behind the decline in the overall OTVI. The Van Outbound Tender Volume Index (VOTVI) is down 2.96% w/w. Both indices are down significantly on a y/y basis — as VOTVI and ROTVI are down a respective 21.4% and 23.2% — but a large portion of this difference is due to declining tender rejections in both modes.

Rejection rates make a last-minute recovery after edging close to 6%

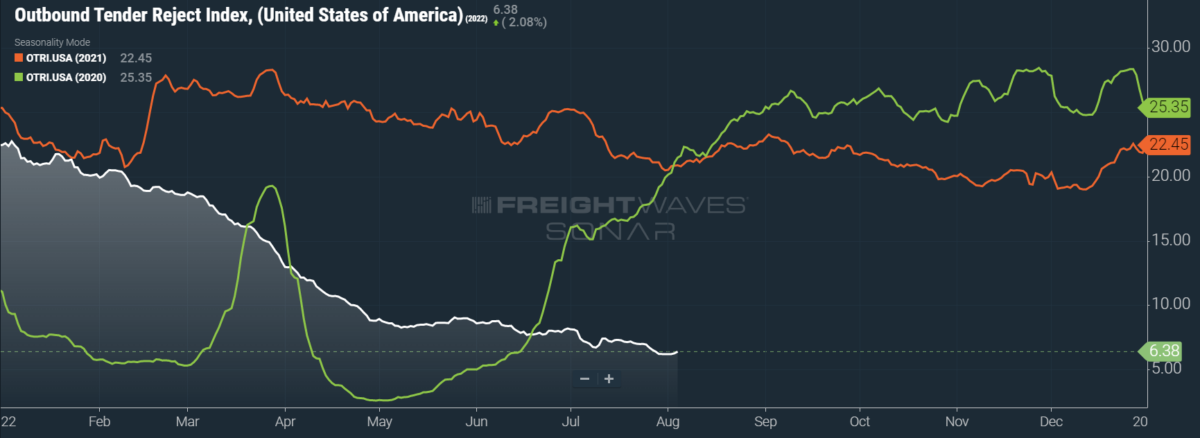

In 2021, tender rejection rates dipped to a local low at the end of July but then began to recover throughout August before peaking in early September. Right now, we are seeing a similar movement in OTRI, though it is still too early to make airtight comparisons. For one counterexample, tender rejections only declined in July 2022, unlike the surging trend of 2021.

SONAR: OTRI.USA: 2022 (white), 2021 (orange) and 2020 (green)

To learn more about FreightWaves SONAR, click here.

Over the past week, OTRI, which measures relative capacity in the market, rose and fell to 6.38%, a change of 0 basis points (bps) from the week prior. OTRI is now 1,450 bps below year-ago levels.

For many readers of this column, the latest release of the Logistics Managers’ Index confirmed what has already been known — namely, that capacity is looser and that rates are on a decline. The LMI’s Transportation Prices Index finally fell below 50, which, per author Zac Rogers, indicates that “we have crossed the Rubicon into a state of contraction for the first time since May of 2020.”

While I appreciate a fellow lover of dramatic, historical metaphors, I would hasten to add that the LMI is based on survey respondents’ awareness of and sentiment about current market conditions. Carriers’ and freight brokers’ pricing power is commonly bolstered by shippers’ relative ignorance of rate movements. FreightWaves’ SONAR market data shows that spot rates have been declining rapidly since March and are now stuck in a rut. However, falling diesel prices might soon reverse course, putting upward pressure on rates once again.

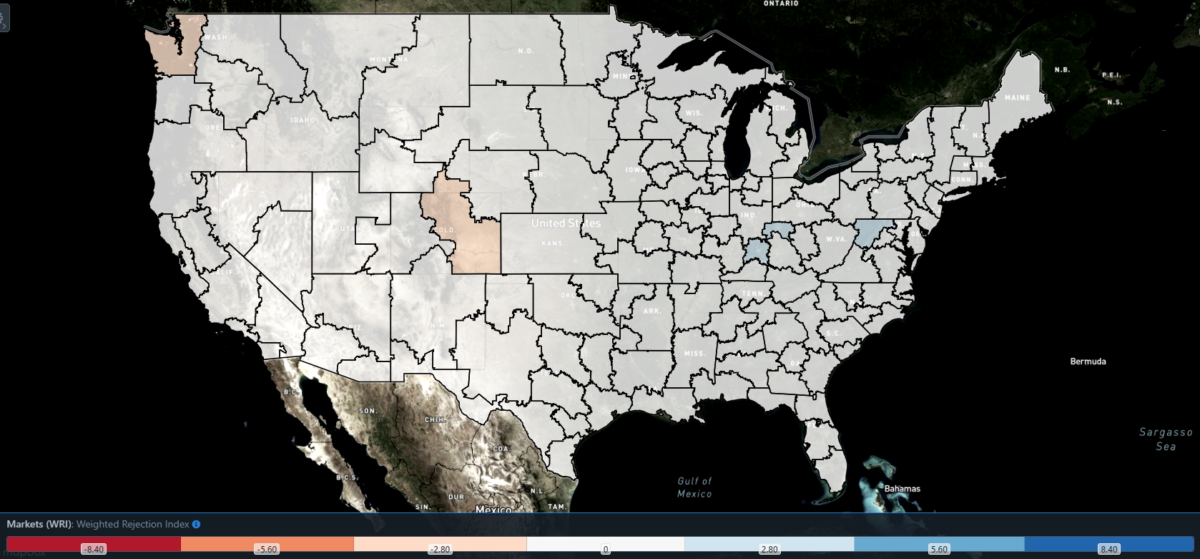

SONAR: WRI (color)

To learn more about FreightWaves SONAR, click here.

The map above shows the Weighted Rejection Index (WRI), the product of the Outbound Tender Reject Index — Weekly Change and Outbound Tender Market Share, as a way to prioritize rejection rate changes. As capacity is generally finding freight, a couple of regions this week posted blue markets, which are the ones to focus on.

Of the 135 markets, 80 reported higher rejection rates over the past week, though 51 of those reported increases of only 100 or fewer bps.

After a remarkable climb to 13% in late June, tender rejections in Atlanta have rapidly deteriorated. Atlanta’s local OTRI is now hovering around 5.39% after dipping to 4.95% on Sunday — its lowest reading in a data set that stretches back to 2017.

Rejection rates in nearby Savannah, Georgia, which receives much of its freight from imports at its seaport, followed a similar trend but have rebounded more quickly. After hitting a low of 4.15% six days ago, Savannah’s local OTRI has since gained 208 bps to reach 6.23%. Given the continued congestion at the Port of Savannah, imports should continue to provide freight to the market.

To learn more about FreightWaves SONAR, click here.

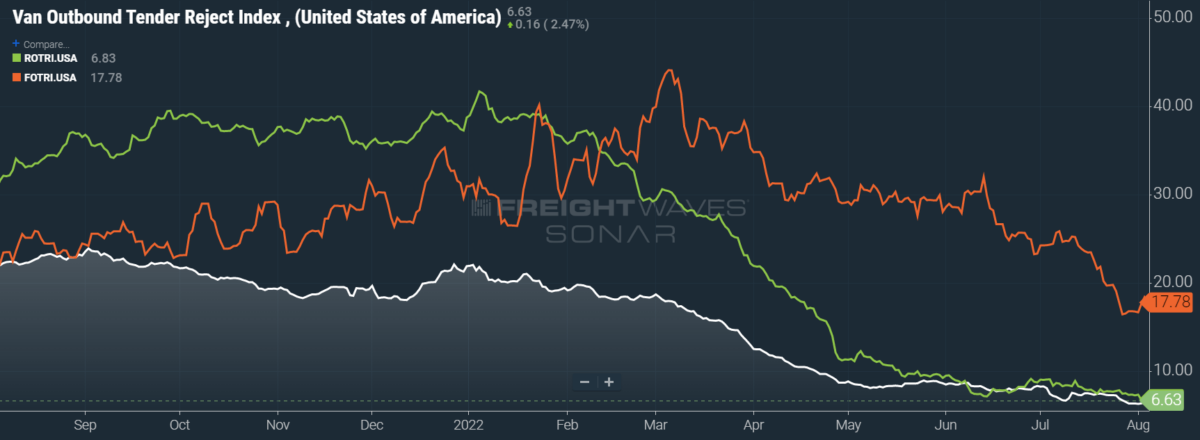

By mode: In less than two months, flatbed rejection rates have fallen by almost half. In mid-June, the Flatbed Outbound Tender Reject Index (FOTRI) was at 32%; at present, FOTRI is loitering around 17.8%, a decline of 1,418 bps. The present decline is alarming but not surprising, as FOTRI has a direct correlation with industrial activity and construction. Given the inflationary pressures on both sectors, coupled with falling housing demand and rising interest rates, it is little wonder that FOTRI is in a downturn.

Despite gains retained in reefer volume, the Reefer Outbound Tender Reject Index (ROTRI) has yet to budge the needle significantly. Over the past week, ROTRI fell 67 bps to 6.83%. Van rejection rates, on the other hand, are rising from Monday’s dip at 6.3% and are up 10 bps w/w at 6.63%.

What in the world are contract rates doing?

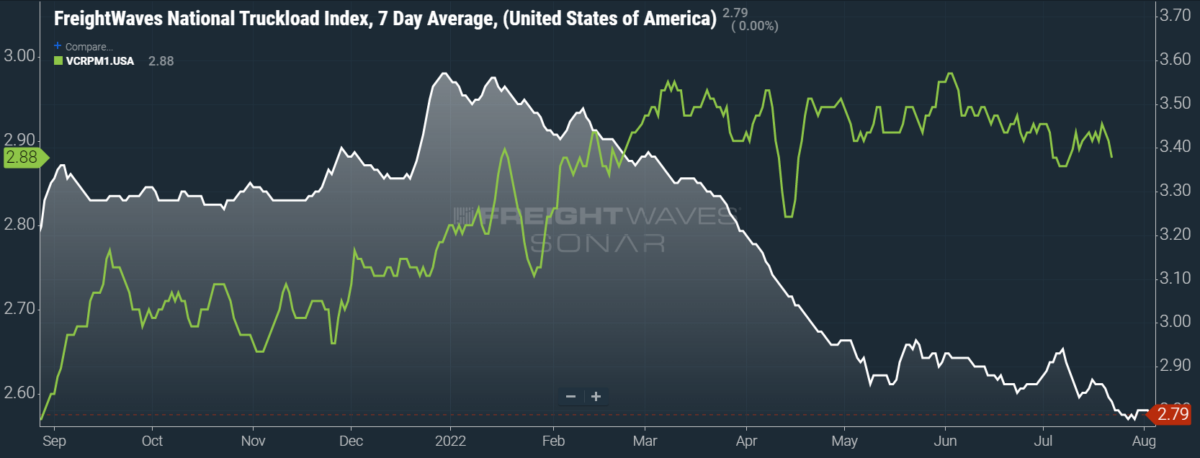

Contract rates have fallen w/w and are a mere cent above July’s low of $2.87 per mile, which was itself the lowest point since mid-April’s 15-cent dip. Without further elaboration, these figures support my hypothesis that contract rates will come down off their previous highs after Q3 renegotiations, which should have favored shippers and their increased pricing power.

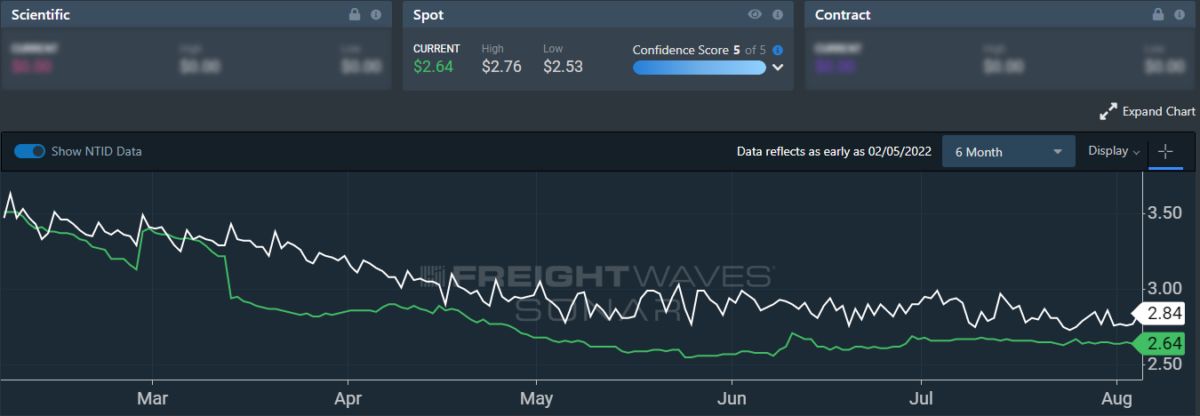

SONAR: National Truckload Index, 7-day average (white; right axis) and dry van contract rate (green; left axis).

To learn more about FreightWaves SONAR, click here.

But this clean narrative would ignore the facts that contract rates only fell at the eleventh hour, tumbling 4 cents per mile in three days; that contract rates (which are reported on a two-week delay) rose and stayed elevated in the 11-day period from July 8 to July 19; and that even the current decline in rates does not meet the significant decline in market conditions.

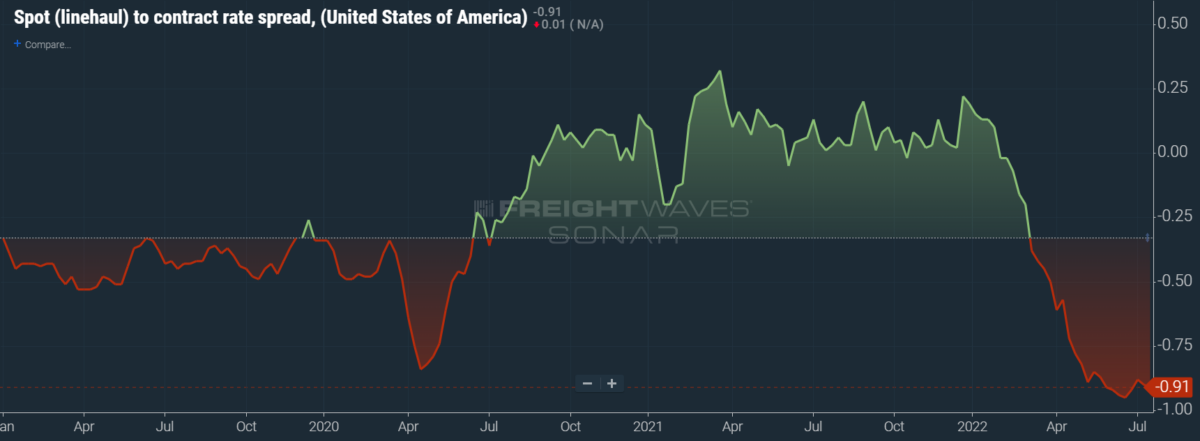

The spread between dry van contract rates and the linehaul variant of the National Truckload Index (NTI), neither of which includes fuel surcharges, has stubbornly remained around 90 cents per mile. Although my previous forecasts stated that the gap between linehaul spot rates and contract rates would not close until Q1 2023 (at the earliest), I still believed that the spread would begin to narrow in July and August.

To learn more about FreightWaves SONAR, click here.

During this period of comparison, the linehaul NTI (NTIL) was on a similar decline and hit a two-year low last week. The NTIL, however, has since gained 2 cents per mile w/w and is sitting at $1.97 a mile. If we are to see a narrowing spread, it will be crucial to see whether contract rates follow suit or if they instead continue their decline. The main NTI, meanwhile, did not move whatsoever last week, remaining at $2.79 a mile.

To learn more about FreightWaves TRAC, click here.

The FreightWaves TRAC spot rate from Los Angeles to Dallas, arguably one of the densest freight lanes in the country, seems to have little room to decline further. Over the past week, the TRAC rate fell 1 cent per mile to $2.64. Compared to the NTID, or the National Truckload Index — Daily, rates from Los Angeles to Dallas are lower than the national average, but that was not the case at the start of the year.

When carriers flooded Southern California back in January, they pushed down spot rates rapidly. Depending on how AB5, California’s newly enforced independent contractor law, affects capacity, however, rates may yet go up in the not-so-distant future.

To learn more about FreightWaves TRAC, click here.

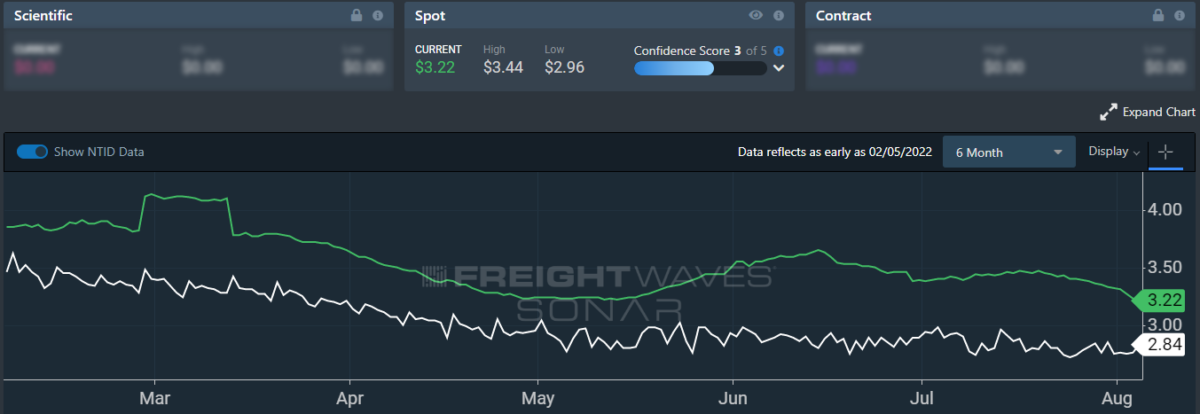

On the East Coast, especially out of Atlanta, rates have suffered a more severe decline but are still beating the daily NTI. The FreightWaves TRAC rate from Atlanta to Philadelphia fell 15 cents per mile this week to reach $3.22. Now that diesel prices have stabilized in the Northeast and Philadelphia is posting higher volume, carriers are less reluctant to head north out of the declining (but still robust) Atlanta market.

For more information on the FreightWaves Passport, please contact Kevin Hill at [email protected], Tony Mulvey at [email protected] or Michael Rudolph at [email protected].