This week’s FreightWaves Supply Chain Pricing Power Index: 25 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 25 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 25 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Consumers are looking at a cruel, cruel summer

Despite expectations for seasonal growth in the second quarter, the health of the American consumer has continued to become more precarious, stirring headwinds for even once-reliable sources of freight. Per data from the IRS, the total amount of tax refunds issued in April was 17.4% less than last year. This April shortfall of roughly $15 billion, which comes on the heels of March’s yearly shortfall of $25 billion, suggests that the average refund in 2023 was approximately 8% lower than 2022.

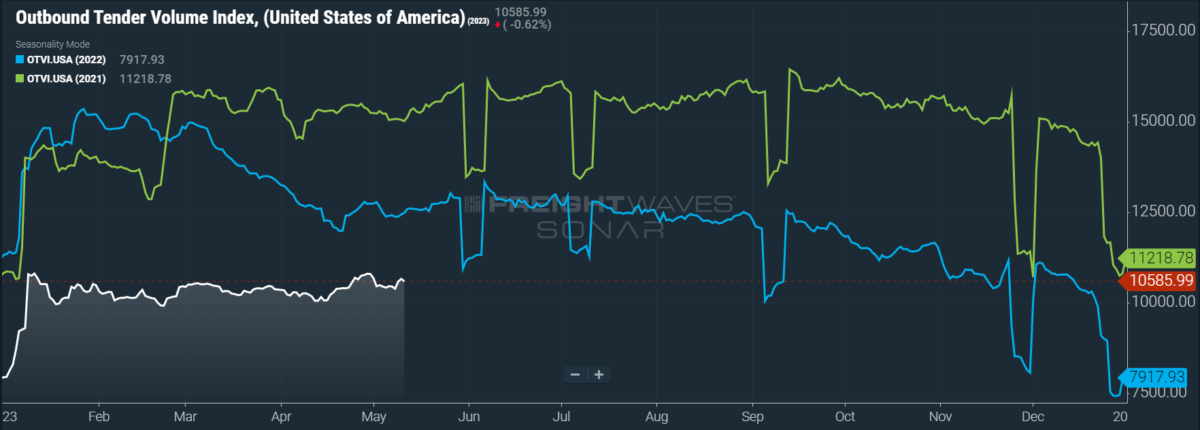

SONAR: OTVI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

This week, the Outbound Tender Volume Index (OTVI), which measures national freight demand by shippers’ requests for capacity, ticked up a slight 1.38% on a week-over-week (w/w) basis. On a year-over-year (y/y) basis, OTVI is down 15.9%, yet such y/y comparisons can be colored by significant shifts in tender rejections. OTVI, which includes both accepted and rejected tenders, can be artificially inflated by an uptick in the Outbound Tender Reject Index (OTRI).

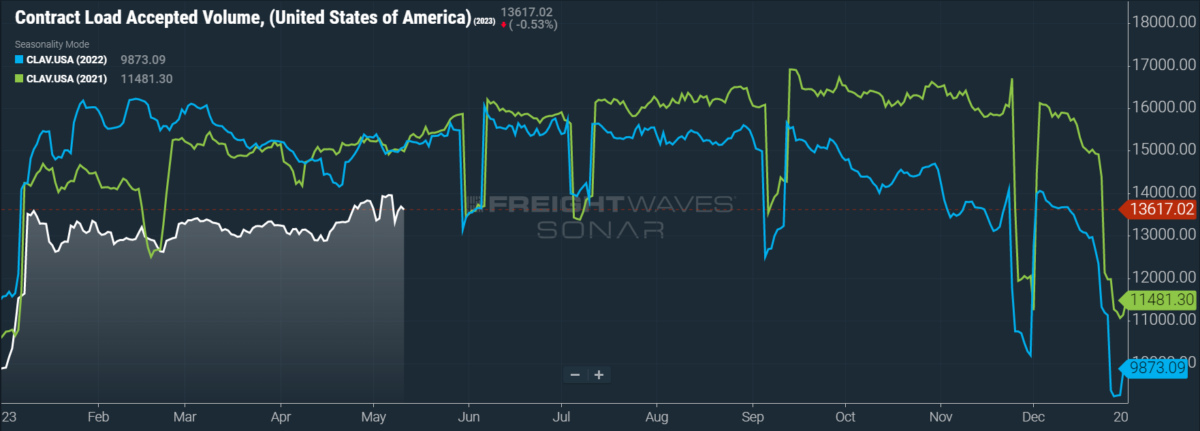

SONAR: CLAV.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volumes (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we actually see a greater decline of 2.3% w/w as well as a fall of 9.7% y/y. This y/y difference confirms that actual cracks in freight demand — and not merely OTRI’s y/y decline — are driving OTVI lower.

Preliminary data indicates that, excluding a notable pickup in auto sales, April retail sales growth over March will be close to zero. Some of the greatest losses in spending were found in service categories like airline travel and lodging, which are relatively immaterial to freight markets. That said, although e-commerce spending ticked up, other drivers of bulky freight like furniture were deeply negative compared to March.

Turning to the future, the situation is especially bleak for LTL brokers and smaller carriers without a foothold in the contract market. Shippers of consumer packaged goods as well as those of food and beverage are increasingly consolidating their loads to save on costs. Sensing that contract rates could be nearing their floor and no longer fearing COVID-related disruptions, these shippers are once again committing to longer bid cycles to take advantage of currently low rates. The good news, such as it is, is that shippers do not appear to be driving contract rates to the bottom of the barrel. Rather, they are content to withhold a full exercise of their pricing power in exchange for high-quality guaranteed service.

Finally, Congress’ ongoing stalemate in deliberations over the debt ceiling could see the U.S. government face its first default in history. Among other consequences, this inability to agree on a compromise would impact salaries of federal employees, pensions and Social Security payments — needless to say, such a disruption would kill consumers’ appetite for discretionary purchases. Additional turmoil in the banking sector is another likely outcome, providing yet another headwind to freight market growth.

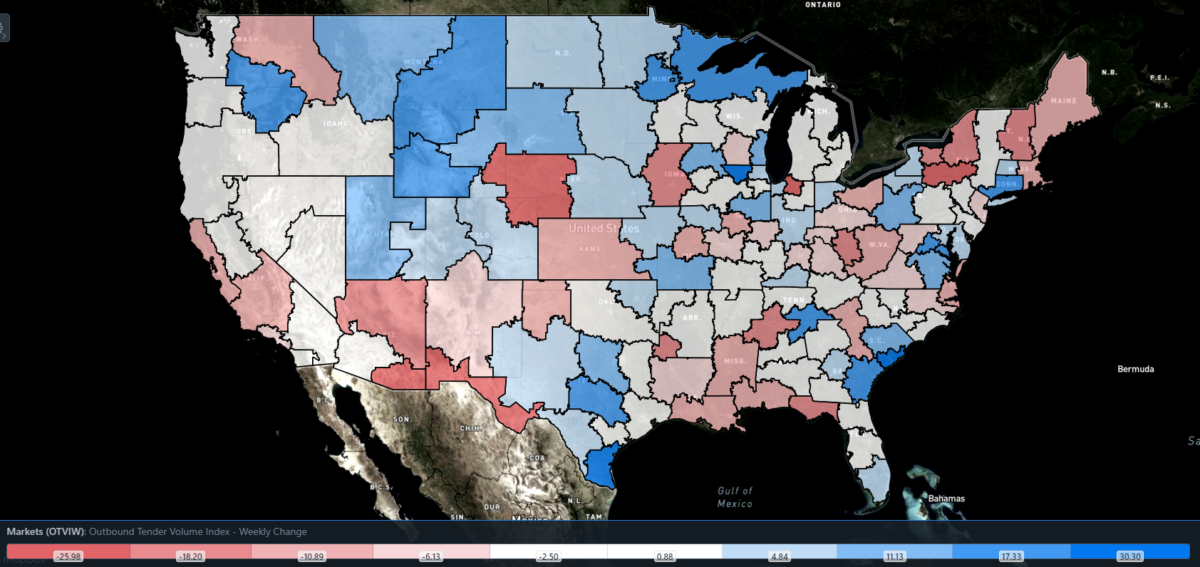

SONAR: Outbound Tender Volume Index – Weekly Change (OTVIW).

To learn more about FreightWaves SONAR, click here.

Of the 135 total markets, 71 reported weekly increases in tender volume, although these gains were inconsistently present across the most major markets.

In accordance with April’s aforementioned growth in e-commerce, Utah’s Salt Lake City market — host to massive Amazon warehouses and distribution centers — has risen in prominence. The region, which now accounts for 1.2% of market share by outbound volume, saw freight demand rise 11.1% w/w.

Looking to the East, Georgia’s coastal Savannah market made an impressive splash this week, with tender volumes rising 22.8% w/w. This growth suggests a return to the port’s nascent stature, as the alternative ports of Houston (which is overwhelmed with exports of oil and other petroleum products) and the twin ports of Los Angeles and Long Beach (which have yet to set labor contracts with their dockworkers’ unions) are fading.

By mode: In the 11th hour of this week, reefer volumes finally rose in accordance with seasonal growth patterns. The Reefer Outbound Tender Volume Index (ROTVI) ticked up 7% w/w, handily outperforming the overall OTVI. That said, produce reefer volumes from California are still subject to the same restraints as they have been since late-winter storms impeded harvesting and planting in the state.

Dry van volumes, on the other hand, are doing relatively poorly as traditional sources of upward pressure are uniformly absent. The Van Outbound Tender Volume Index (VOTVI) is up only 1.2% w/w.

Carrier compliance rises to all-time highs, outdoing April 2020

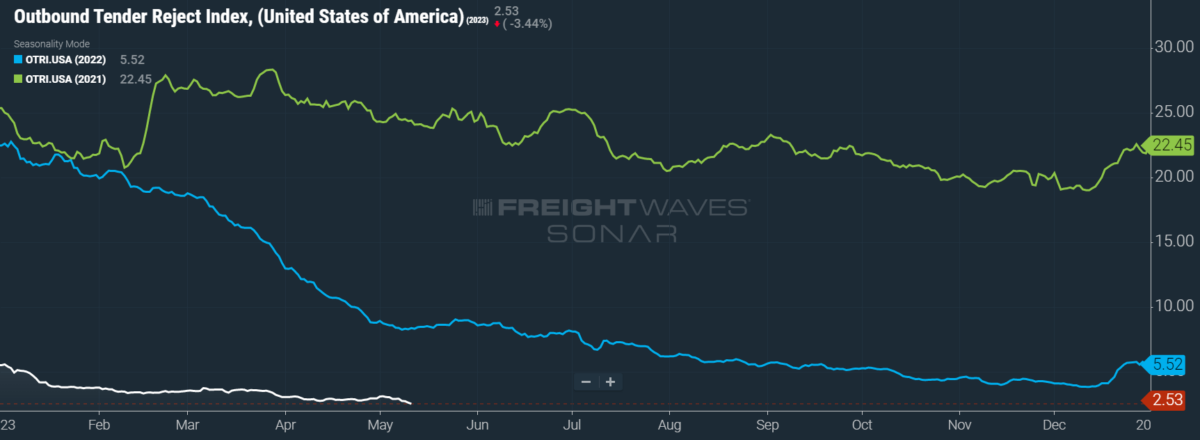

Incredibly, OTRI managed to sink to a new all-time low this week. The previous low of 2.57% was reached during the incredible circumstances of April 2020, when the entire Western world ground to a screeching halt during the onset of the COVID-19 pandemic. We have long since fallen below August 2019’s more normal low of 3.78%, which was set simply by cyclical market factors that led to an industrywide recession.

In a broad sense, there is not a great deal of difference between 2.57% and 3.78% in terms of market health — both figures point to rampant deterioration in carriers’ pricing power. What the difference does signify, however, is the relative pain of these carriers. There were some that scraped through the previous trucking recession only to be taken out by the pandemic. When looking at these figures, carriers might reflect on how they functioned during these previous lows for a window into what lies in store.

SONAR: OTRI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Over the past week, OTRI, which measures relative capacity in the market, fell to 2.53%, a change of 51 basis points (bps) from the week prior. OTRI is now 584 bps below year-ago levels, with y/y comparisons becoming only more favorable as the year progresses.

Another round of layoffs has unsurprisingly come for brokerages and carriers. U.S. Xpress, an enterprise carrier nearing acquisition by Knight-Swift, has laid off roughly 150 employees. With its average truckload revenue per mile falling 11.55% y/y in Q1, the company recently reported major losses to the Securities and Exchange Commission. A spokeswoman for the Chattanooga, Tennessee-based carrier pinned these losses on “a prolonged lack of freight demand that has negatively affected trucking logistics companies.” While many of these layoffs occurred in U.S. Xpress’ administrative and brokerage segments, some were also found in the company’s asset-based division. On a similar note, some 20 employees were laid off from Lipsey Logistics, a brokerage also based in Chattanooga.

SONAR: WRI (color)

To learn more about FreightWaves SONAR, click here.

The map above shows the Weighted Rejection Index (WRI), the product of the Outbound Tender Reject Index — Weekly Change and Outbound Tender Market Share, as a way to prioritize rejection rate changes. As capacity is generally finding freight this week, a few regions posted blue markets, which are usually the ones to focus on.

Of the 135 markets, 53 reported higher rejection rates over the past week, though 34 of those saw increases of only 100 or fewer bps.

To learn more about FreightWaves SONAR, click here.

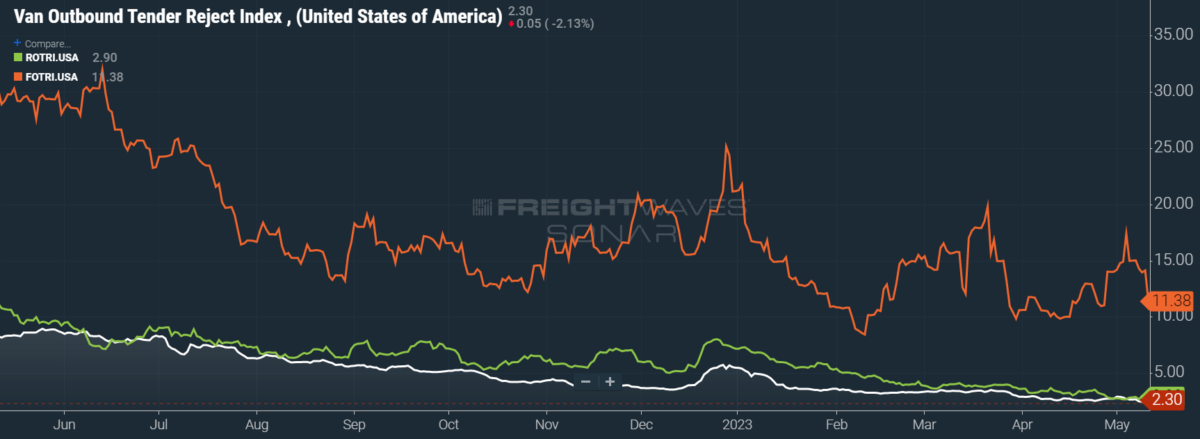

By mode: After a brief rally earlier this month, the Flatbed Outbound Tender Reject Index (FOTRI) has fallen nearer to the single digits. Demand from the construction sector is currently weak, as high interest rates are prohibiting any desire for such investments. Housing prices are also tumbling rapidly, especially in those markets like Austin, Texas, that saw a flurry of activity during the pandemic-era onset of the work-from-home movement. FOTRI fell 602 bps w/w to 11.38%.

The remaining modes have comparatively less room to fall, though dry van rejection rates found room anyway. The Van Outbound Tender Reject Index (VOTRI) slid 41 bps w/w to 2.3%, in line with the aforementioned demand weakness from CPG shippers. The Reefer Outbound Tender Reject Index (ROTRI), meanwhile, rose 22 bps w/w to 2.9%, bouncing back from last week’s all-time low of 2.67%.

Texas tea is far from sweet

Could spot rates be any worse? It’s a question that I’ve asked repeatedly over the past few months, with the answer invariably being yes. This frustrating capacity for spot rates to find new ways to decline could end up surprising shippers that are locking in contract rates at what they believe to be the bottom.

Oil traders are similarly being surprised by the rapid decay of global crude prices. Juiced by production cuts from Saudi Arabia and its allies in early April, oil prices have succumbed to bearish fears over a broad economic recession and China’s sketchy recovery. Bullish fears of global demand outweighing supply are largely irrelevant. This downward trend is set to continue diesel fuel’s protracted price slump.

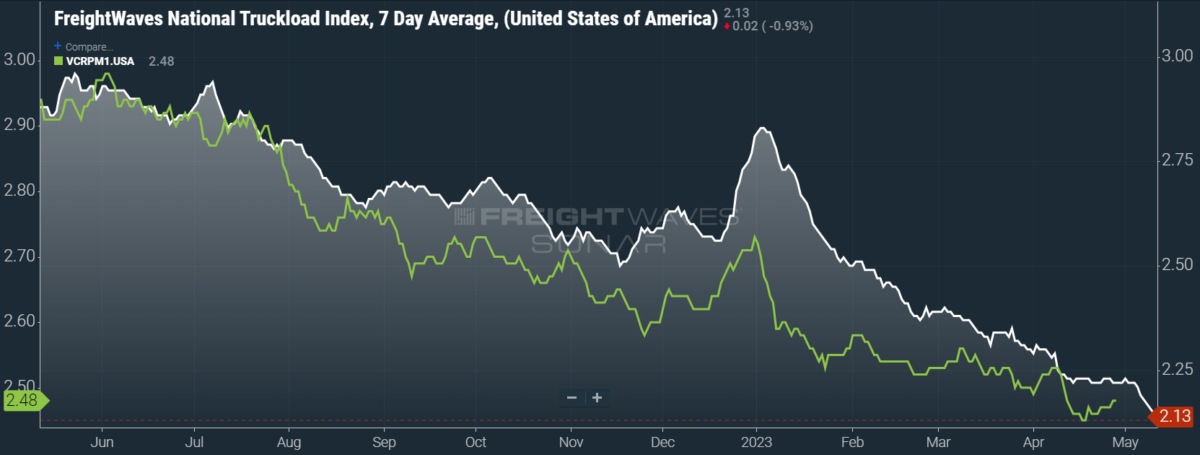

SONAR: National Truckload Index, 7-day average (white; right axis) and dry van contract rate (green; left axis).

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharges and other accessorials — fell a brutal 9 cents per mile, hitting $2.13. Linehaul rates posted a similar performance, with only a fraction of the NTI’s decline attributable to falling costs of diesel fuel. The linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — tumbled 8 cents per mile w/w to $1.50.

Contract rates, which exclude fuel surcharges and other accessorials like the NTIL, are largely exempt from the drama surrounding diesel prices since fuel costs are often a pass-through for carriers running contracted loads. Contract rates — which are reported on a two-week delay — gained 2 cents per mile to reach $2.48. In Q2 so far, contract rates have declined 2.4% from Q1’s average of $2.55. This stability, while still bitter to carriers, shows a broad level of restraint from contract shippers.

To learn more about FreightWaves SONAR, click here.

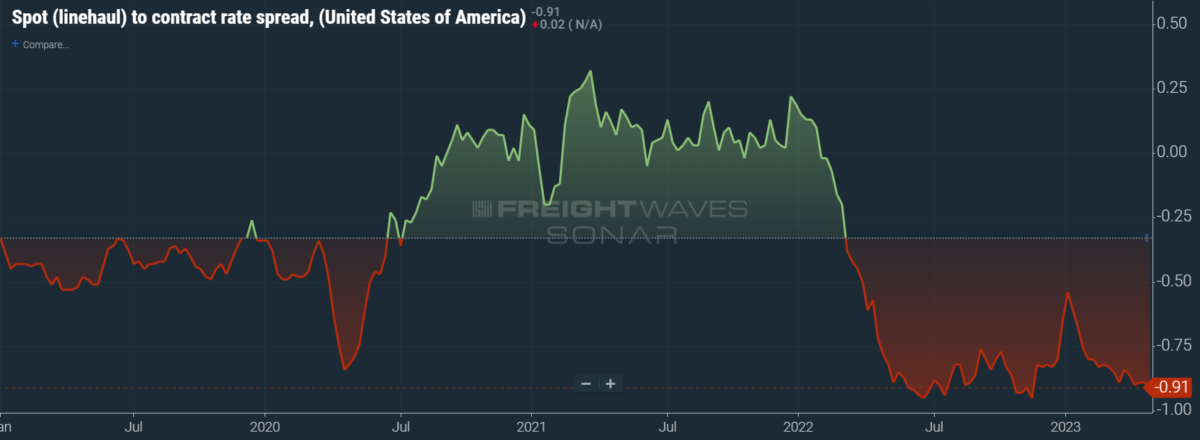

The chart above shows the spread between the NTIL and dry van contract rates, revealing the index has fallen to all-time lows in the data set, which dates to early 2019. Throughout that year, contract rates exceeded spot rates, leading to a record number of bankruptcies in the space. Once COVID-19 spread, spot rates reacted quickly, rising to record highs on a seemingly weekly basis, while contract rates slowly crept higher throughout 2021.

Despite this spread narrowing significantly over the first few weeks of the year, tightening by 20 cents per mile in January, it has continued to widen again. Since linehaul spot rates remain 91 cents below contract rates, there is still plenty of room for contract rates to decline over the coming months.

To learn more about FreightWaves TRAC, click here.

The FreightWaves TRAC spot rate from Los Angeles to Dallas, arguably one of the densest freight lanes in the country, has been seeing some growth from a likely floor. Over the past week, the TRAC rate rose 7 cents per mile to $1.87 — still a far cry from its year-to-date high of $2.39. The daily NTI (NTID), which sits at $2.12, is handily outpacing rates from Los Angeles to Dallas.

To learn more about FreightWaves TRAC, click here.

On the East Coast, especially out of Atlanta, rates rose and are outpacing the NTID. The FreightWaves TRAC rate from Atlanta to Philadelphia rose 3 cents per mile w/w to $2.39. A muted but sustained rally has been seen along this lane since April’s low of $2.27 per mile.

For more information on FreightWaves’ research, please contact Michael Rudolph at [email protected] or Tony Mulvey at [email protected].