Less-than-truckload carrier Saia appears to be holding the volume influx it received following the shutdown of Yellow.

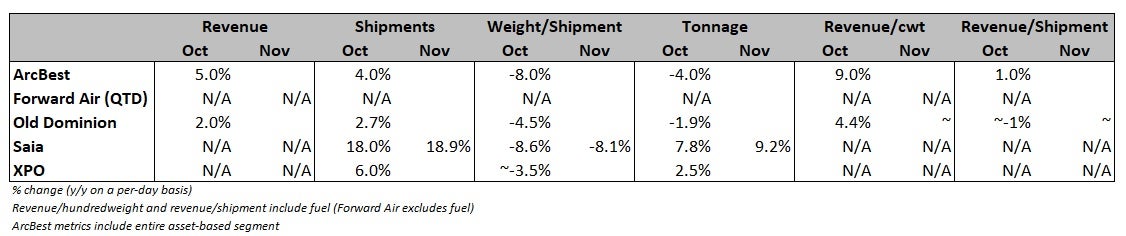

The company reported a 9.2% year-over-year (y/y) increase in tonnage per day during November, which followed a 7.8% increase in October. The acceleration was in part due to softer comparisons to last year. Saia recorded y/y tonnage declines of 3% and 7.1%, respectively, in October and November of 2022.

Saia’s (NASDAQ: SAIA) 2023 fourth-quarter tonnage increases were driven by high-teens growth in daily shipments, which were partially offset by weight per shipment declines of more than 8%.

October had some impact from a cyberattack at Estes, however, some of the carriers that saw a bump in volumes due to the event said that the freight had flowed back to Estes by the end of the month.

Saia’s current growth rates imply tonnage will be down by roughly 5% in the fourth quarter, which is a little bit better than normal seasonality.

“While the acceleration in volume is partly comp related (and we expect another acceleration in December due to even easier comps), today’s announcement does support the view that SAIA is holding on to the majority of its market share gains despite its focus on price and profitability,” Deutsche Bank (NYSE: DB) analyst Amit Mehrotra told clients in a Monday morning note.

Saia’s tonnage was down 13.2% y/y last December. Less-than-truckload demand turned negative at the end of the 2022 summer with the y/y declines accelerating to close the year.

“We also didn’t see anything surprising in weight per shipment trends from October to November vs. what we would normally expect (down 0.6% sequentially), which further supports the view that SAIA is holding on to its market share gains,” Mehrotra continued. “December volumes will also be important, given the company’s GRI [general rate increase] takes effect today (December 4).”

Yellow’s exit has prompted some carriers to implement annual GRIs ahead of schedule. Saia’s recent announcement of a 7.5% increase was 100 basis points higher than its prior GRI and the implementation came two months earlier.

Saia saw the biggest sequential increase in shipments among publicly traded carriers during the third quarter, the first reporting period following Yellow’s collapse. Saia responded by adding more than 1,000 employees to its existing head count of roughly 12,000. It has also been adding terminals and equipment in certain markets to accommodate the share wins.

During the third quarter, Saia’s tonnage per day was up 6.7% y/y as shipments increased 12.2% and weight per shipment was down 5%. The company doesn’t disclose yield metrics in its intraquarter updates but revenue per hundredweight excluding fuel surcharges was 8.4% higher y/y in the third quarter.

The broader industrial complex, which generates roughly two-thirds of the freight moved through LTL networks, remains in decline. The Manufacturing Purchasing Managers’ Index remained unchanged at 46.7 during November and below the neutral threshold of 50 for a 13th straight month. The new orders component of the index did improve 2.8 points to 48.3.

Soft demand throughout the industrial sector has been a primary headwind for LTL shipment weights.

More FreightWaves articles by Todd Maiden

- Auction for Yellow’s terminals ‘remains ongoing’

- Lineage Logistics reported to be pursuing $30B-plus IPO

- Forward Air, Omni pointing fingers over EBITDA forecasts

Craig Radcliffe

Well I have read a lot of articles about the central states pension. I’m sorry yellow failed their employees again but the fact is at least they had a pension till 2023 the Western states lost it and 15% pay for 10 to 12 years and all their equipment was leased anyways or they owed on them look into the board members bonuses any bonuses they got from 2009 to 2023 needs to pay it all back the company was poorly managed and run. It’s real funny on how back in 2009 or 2010 the company claims they sold all real estate to make the bills. It has been shown all lies.

PHILIPPE MARTEL

NOTHING ON TFI USA DIVISION