Just three weeks ago, the monthly FreightWaves “State of Freight” webinar for February didn’t feature many bullish factors that our experts were seeing in the market.

(Note: the March State of Freight webinar can be seen here.)

During the March “State of Freight” webinar, the outlook was generally as bearish as earlier. With at least one indicator turning slightly higher, there may have been at least a glimmer of optimism this time around.

But a new member of the FreightWaves team brought his expertise to the table, and what he said was as pessimistic as most other market signals.

Here are this month’s five takeaways from the March webinar:

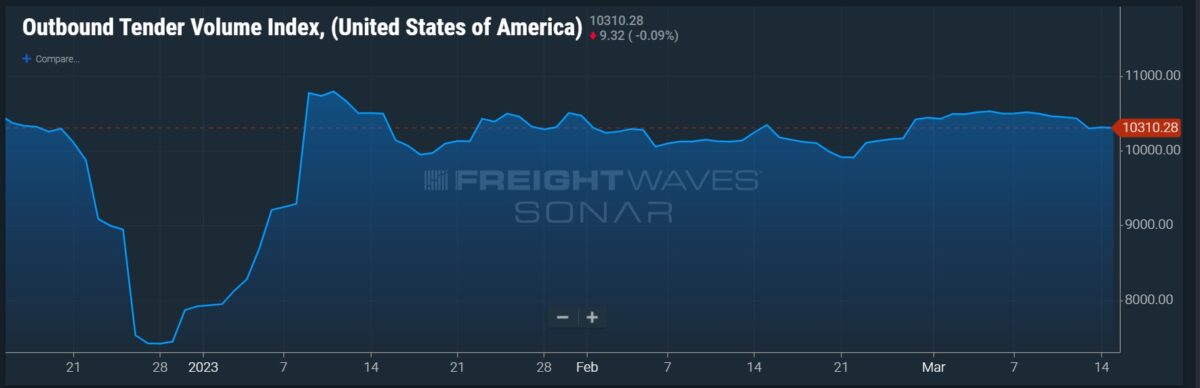

What OTVI is telling us

FreightWaves market expert Zach Strickland pointed out the current shape of the data coming out of the Outbound Tender Volume Index is seeing some bullishness. “At the very end, we have a little sign of increase,” Strickland said of the recent OTVI chart.

CEO and founder Craig Fuller said what he viewing is “normal seasonality,” describing a freight market that already would be seeing gardening equipment and other summer purchases. Beverages would be in there also.

Although there is a seasonal increase, Fuller said he was “actually disappointed. I would have expected that in mid-March we would be higher than we were in January.” Fuller described the slight recent upward move as a “little bump that does not suggest we are on a run. We’re in spring, but I don’t see the signs of a spring season.”

Strickland conceded he leans toward the bearish side but was remaining bullish based on that upturn in the OTVI.

“I like any inflection of seasonality I’ve seen in March,” Strickland said. “That OTVI has been on a seven-month decline, so this increase makes me feel better that maybe this is a demand bottom.”

Banking crisis’ precise impact on trucking definitely won’t be positive

Recapping the steps of just the previous 24 hours, including the Swiss government’s support of Credit Suisse, Fuller said that “could have been a global crisis has now probably been stemmed.”

But an economy can’t come through something like this and just easily walk away from it.

“I think the question is does this create a longer-term impact on consumer spending and capital spending,” Fuller said. “At a minimum [what has happened in recent days will] force investors to pull back and slow down spending, just because companies are just getting more conservative.”

The headwinds piling up are substantial, according to Fuller, ticking off a stock market that’s still 20% off its highs, a potential banking crisis, inflation and “the largest set of increases by the Federal Reserve in recent memory.” And some of it has happened rapidly, “so there are so many reasons to be risk averse.”

One area of strength may be ebbing

Fuller noted that his controversial FreightWaves article predicting a “trucking bloodbath” is just about 1 year old. Given what has occurred in the freight market by most definitions constitutes just that, Fuller said one area of strength still in the market is instead showing some signs of weakness.

“One part of the economy that has not been hit yet has been travel and services,” he said. “But if you start to listen to some of the anecdotal evidence coming out, you’re starting to see that they aren’t seeing the momentum they had. So the early signs are that the service sector may be getting a little tired. [And in travel] they’re not seeing the levels of bookings that they were seeing over the last few months.

Fuller added it’s not a “significant” slowdown in those sectors, “but the anecdotal stuff is that people are pulling back a bit, and that could impact some of that consumer spending.”

Capacity still plentiful and job shifts may keep it loose

Fuller said he has spoken with people in the construction industry and they are starting to see a loosening of availability out of the trade occupations that need to be hired for a project.

“They tell me that they are getting calls from trades people who six months ago wouldn’t call them back, and now they’re begging for work,” he said.

Where this might impact trucking is with that long-established and well-trod route for a worker shifting between construction and driving.

“The supply of all those folks entering the market is going to create more truck drivers,” said Fuller, noting they remain the key capacity constraint in trucking.

Fuller cited the relatively low level of bankruptcies in the industry as a sign that capacity in the market is not yet shaking out.

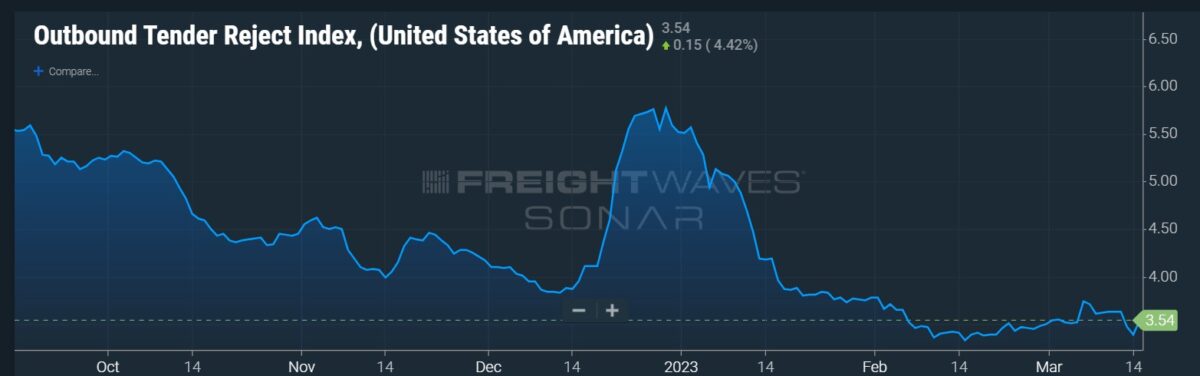

“We’re not seeing the wholesale washout of capacity the way you saw it in 2019,” he said. And with the still-low Outbound Tender Rejection Index (OTRI) below 4 signaling plenty of capacity softness, and the ability to get drivers behind the wheel likely to rise when that shakeout picks up steam, “it is going to make it harder to get any pricing power in the market.”

Tender rejections need to rise, and that will give rates a chance to follow. Until that happens, Fuller said “every trucking executive in the market is not seeing any signs of hope. That is going to be pretty traumatic to how they think about their business going forward.”

Packaging expert sees no upturn

Adam Josephson was a managing director at KeyBanc Capital Markets covering paper and packaging before recently joining FreightWaves as a senior vertical expert. From that previous perspective, he told the webinar he did not see any upturn in signals from that leading indicator industry.

Josephson said the fourth quarter of 2022 was the worst quarter for the box industry in six years. The industry was going through “major inventory destocking” in Q4 but that packaging executives thought Q1 would see an upturn after that process had “played itself out and demand would have improved.”

Insead, Josephson said “there have been no signs of that blip.” While the first two weeks of January did show some improvement over the weak fourth quarter, “since then it has receded.” As bad as Q4 demand in packaging was, Josephson described Q1 as flat compared to the fourth.

When he speaks to executives in the paper segment about where they think the market is going, “the answer is that they have no idea whether things will improve over the next six months. So it’s a little dicey out there.”

The next “State of Freight” webinar is set for April 20 at 2 p.m. EDT. There is no specific link for signup yet, but general information can be found at freightwaves.com/events.

More articles by John Kingston

California’s Prop 22 survives; appellate court reverses lower court finding

Pilot, now backed by Berkshire Hathaway, sees S&P debt rating rise

Decline in truck transportation jobs 2nd biggest in last decade