Werner Enterprises said Wednesday that volumes during this year’s peak season will shake out largely in line with last year but pricing will be notably lower.

The company’s rate guidance for the fourth quarter calls for revenue per total mile in its one-way segment to be flat to slightly down from the third quarter but off 7% to 9% year over year (y/y). Its outlook for the dedicated fleet was unchanged as revenue per truck per week is still expected to finish the full year flat to up 3%. That metric was up 1.8% year to date through the third quarter.

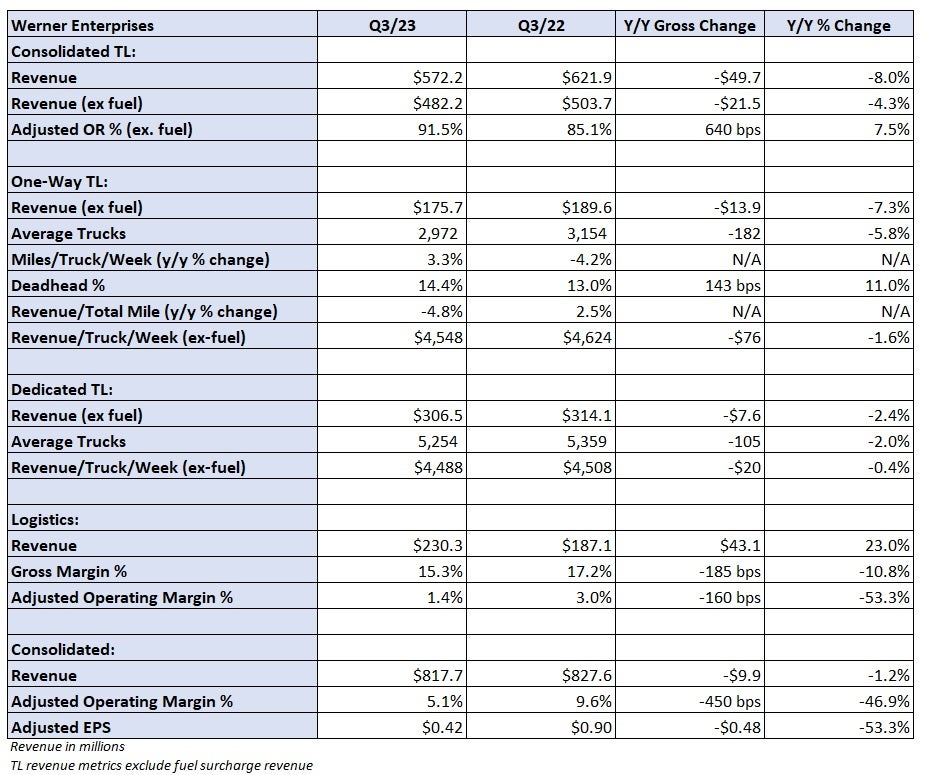

Werner (NASDAQ: WERN) reported third-quarter adjusted earnings per share of 42 cents, 7 cents light of the consensus estimate and 48 cents lower y/y.

Compared to the year-ago quarter, lower gains on sale were a 14-cent headwind, net interest expense was a 5-cent headwind (increased debt from past acquisitions) and a lower tax rate was a 1-cent tailwind. The result excluded 5 cents in acquisition-related expenses and costs from an insurance claim that has been appealed.

Revenue in the company’s truckload segment was 8% lower y/y to $572 million, down 4% y/y excluding fuel surcharges.

Dedicated revenue was down 2% y/y excluding fuel surcharges as average trucks in service were off by a similar percentage. Revenue per truck per week (excluding fuel) was down just slightly y/y.

Management noted some customers are using fewer trucks on average than they were a year ago. However, it said truck counts with its largest customer, Dollar General (NYSE: DG), were up sequentially. Werner also has plans for further expansion with the company, which has been a concern as Dollar General is building its own private fleet.

“Inside the building our confidence level is high relative to that relationship,” said Derek Leathers, chairman, president and CEO, on a Wednesday call with analysts.

One-way revenue was down 7% y/y excluding fuel surcharges as average trucks in service were down 6% and revenue per truck per week was off 2% excluding fuel. Revenue per total mile (excluding fuel) was down 5% y/y in the period.

The TL segment recorded a 91.5% adjusted operating ratio, which was 640 basis points worse y/y. Werner has identified more than $43 million in cost savings opportunities, of which 70% has been realized.

The company plans to continue to reduce its average tractor age to reduce maintenance expenses. The expense line was 80 bps lower y/y as a percentage of consolidated revenue. The average tractor age was 2 years in the third quarter compared to 2.3 years in the same period last year. The company was running more than 500 trucks with over 400,000 miles a year ago. It’s now operating fewer than 50 units with high mileage currently.

Logistics revenue increased 23% y/y to $230 million in part due to the acquisition of ReedTMS last November. Lower revenue per load in truck brokerage was a headwind. Excluding the acquisition, loads were 8% higher y/y and up 9% from the second quarter.

The logistics unit reported a 1.4% adjusted operating margin, which was 160 bps worse y/y and 100 bps lower than in the second quarter.

More FreightWaves articles by Todd Maiden

- Omni Logistics asks court to force Forward Air to closing table

- Forward’s new plan may not include Omni

- Where did Yellow’s freight go?