Less-than-truckload carrier XPO saw service metrics improve in the third quarter even as it took on additional freight following Yellow’s shutdown.

A 0.4% claims ratio was the best in company history and its on-time percentage increased 8 percentage points. By comparison, XPO’s claims ratio was 0.7% in the second quarter and 1.2% two years ago. The improvements were realized alongside an 8% year-over-year (y/y) increase in shipments.

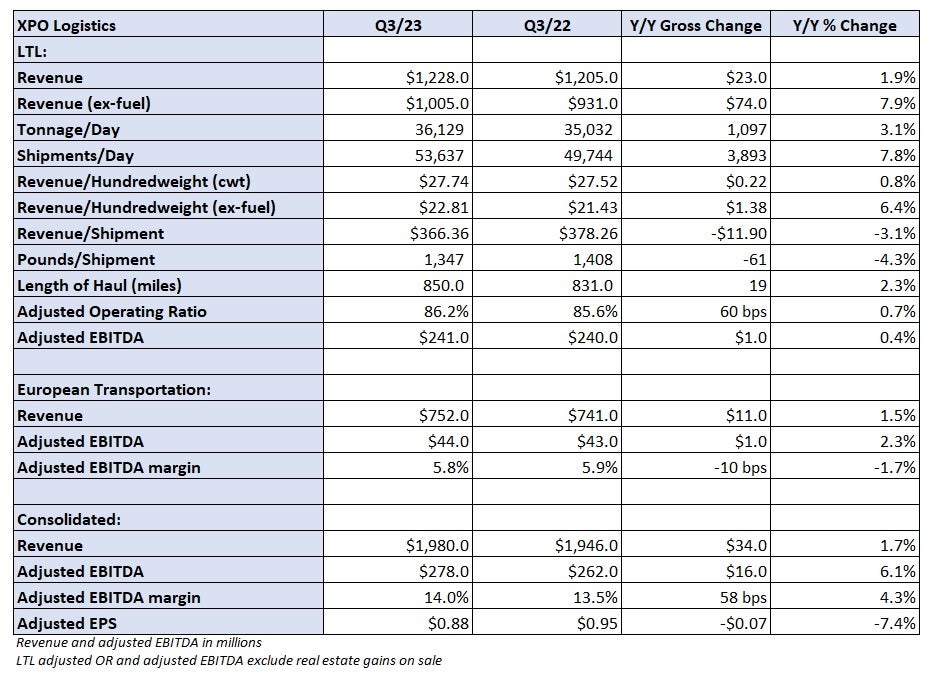

XPO (NYSE: XPO) reported adjusted earnings per share of 88 cents before the market opened Monday. The result was 25 cents better than the consensus estimate but 7 cents lower y/y. Adjusted EPS excludes transaction and restructuring costs.

Revenue in the company’s LTL segment increased 2% y/y to $1.23 billion. Tonnage per day was up 3% and revenue per hundredweight, or yield, increased 6% excluding fuel surcharges. The yield metric was aided by a 4% decline in weight per shipment. Pricing increased by 9% on contract renewals during the quarter, nearly double the increase booked in the second quarter.

Management said average shipments per day increased by more than 1,000 in each month of the quarter to over 54,000 in September. In total, average daily shipments were up 5% from the second quarter to the third quarter. Yield (excluding fuel surcharges) was 6% higher sequentially and weight per shipment was off just 2%.

The positive y/y volume trends continued in October with tonnage up 2.5% y/y and shipments 6% higher. Both volume metrics declined slightly from September levels but outpaced normal seasonal sequential trends.

The LTL segment recorded an 86.2% adjusted operating ratio, which was 60 basis points worse y/y but 140 bps better sequentially. Favorable yield trends, improved service and cost management led to the improvement.

Purchased transportation expenses were down 230 bps as a percentage of revenue. The company reduced outsourced linehaul miles to 21.5% of total linehaul miles, which was 200 bps lower y/y. XPO is in the process of adding a few hundred driver teams and tractors with sleeper cabs to insource more linehaul miles. The goal is to reduce total outside miles by 50% over a six-year period ending in 2027.

Head count was down slightly y/y and labor hours were up less than 1% even though the carrier took on an 8% increase in shipments. An annual wage increase implemented in April was a headwind. Insurance and claims expenses were 100 bps lower y/y as well.

The company normally sees 310 bps of OR deterioration from the third quarter to the fourth quarter but expects to outperform that threshold by 100 bps this year. The unit saw 370 bps of sequential improvement versus seasonality in the second quarter. XPO noted that investing in incremental network capacity resulted in a 120-bp headwind in depreciation and amortization expenses in the third quarter. Additional hiring of sales professionals also presents a modest hurdle.

Yields are expected to continue to improve given the carrier’s improved service, which it says customers are willing to pay a premium for. Also, it will look to expand accessorial programs in certain verticals and add more local shipping customers, which carry better margins.

Shipments in its local sales channels increased by double digits in the third quarter.

XPO plans to implement a general rate increase (GRI) to base rate tariffs in the first quarter of next year, which is on schedule with the time frame of a GRI taken earlier this year.

Fourth-quarter tonnage is expected to increase by a low-single-digit percentage and yield is expected to increase by a high-single digit percentage compared to the 2022 fourth quarter.

The company plans to increase capital expenditures from a range of 8% to 12% of revenue to 12% to 13% this year and will likely remain at the higher end of that range in the near term.

It broke ground on a central Florida service center last week. The site will add 60 doors and is part of the company’s larger plan to add 900 net doors by the first quarter of next year. XPO has added 531 new net doors toward the goal so far.

It has also added more than 1,000 tractors this year and plans to build more than 6,000 trailers at an in-house production facility.

XPO’s European transportation segment recorded a 2% y/y revenue increase to $752 million and a 5.8% adjusted EBITDA margin, which was down 10 bps y/y.

Shares of XPO were up 16.1% on Monday at 3:20 p.m. EDT compared to the S&P 500, which was up 1.4%.

More FreightWaves articles by Todd Maiden

- ArcBest prudent in approach to new freight opportunities

- Auction houses to liquidate Yellow’s tractors, trailers

- Heartland books Q3 loss, cuts unprofitable customers and lanes